Should President Obama politicize the Federal Reserve? If so, what would he accomplish? Ezra Klein of the Washington Post seems to think he should, and that this would somehow magically create jobs – but you would look long and hard for an explanation of how this would work.

For those of you unfamiliar with his work, Klein is the Washington Post’s resident left-wing blogger (as opposed to its resident left-wing activist, Greg Sargent, or its resident right-wing bloggers or activists…of which it employs none) and one of the prime examples of a paid, professional left-wing blogger who has never held a job besides blogger/pundit. Klein is well-read, wonkish and earnest to a fault – he’s perhaps the last man in Washington who takes government financial projections at face value – but often comically insulated from how the world works, and why. I follow his Twitter feed in large part for the entertainment value of watching him attempt to navigate the most mundane daily tasks – he gives off the impression of a man who can’t brush his teeth in the morning without a position paper telling him how. I suppose in some ways I was like that myself once, but then I went to law school, got married, got a job, kids, a house, a mortgage…the sort of things that force you to engage the world at a level other than theory.

Anyway, Klein posted yesterday on his enthusiasm for a piece by Neil Irwin, also in the WaPo, on the opening of a third vacancy at the Fed and what it could mean for monetary policy going forward. Klein writes:

When people talk about the need for Democrats and the administration to focus on jobs, nothing they could get through Congress could plausibly be half as important as maximizing their long-term impact on the composition of the Federal Reserve….

Kohn’s resignation is the fifth possible opening on the Federal Reserve Board. Two other possible slots were filled: The first went to Daniel Tarrulo, a banking expert who advised the campaign and is now overseeing banking regulation at the Fed. The second was Ben Bernanke’s renomination, and whatever you think of the merits of reappointing Bernanke, it certainly did not represent the administration’s decision to try to leave their imprint on the Federal Reserve.Every smart economic observer I know is baffled by the administration’s failure to nominate anyone for the two slots that have been empty for months. Those are votes and arguments that the administration could have put at the Fed’s table and has simply chosen not to…I’m not versed enough in this stuff to have any candidates in mind. But the critique of the administration’s strategy on jobs that I find compelling is that they’ve not had any coordinated strategy when it comes to the Federal Reserve.

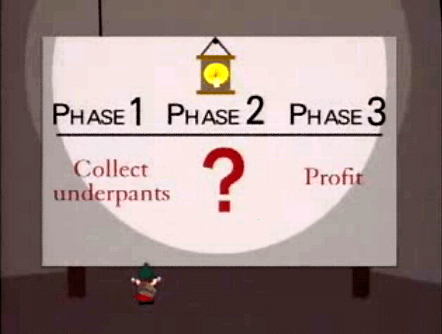

Klein further enthused on Twitter that his post was “something major the Obama administration actually could do about the jobs situation, but hasn’t.” Except, nowhere does he actually get around to explaining how the Obama Administration putting its “imprint” or “impact” or “arguments” on the Federal Reserve Board would change Fed policy, let alone create jobs where none exist today. It’s Underpants Gnomes logic: Step one: appoint left-wingers to the Fed. Step two: ??? Step three: Profit!

To get even a vague idea of how Klein expects this to work, you have to dig into the 18th through 21st paragraphs of Irwin’s story:

At the moment, Fed officials are unified behind a policy of ultra-low interest rates to support the economy. But as the economy improves, some officials, especially presidents of regional Fed banks, are likely to be more eager than Bernanke to raise interest rates and drain the money supply, even at the risk of slowing the recovery. There are early signs of those pressures emerging, including a decision by Kansas City Fed President Thomas Hoenig to dissent at the last policymaking meeting, preferring not to promise to leave rates low for an “extended period.”

New Obama appointees could push the center of gravity of the committee in the president’s preferred direction. Fed watchers generally expect the president to favor appointees who would be in line with Bernanke’s thinking or perhaps even more tilted toward worrying about unemployment as opposed to inflation.

Some liberal economists argue that the president should quickly appoint Fed governors who would be inclined to leave rates low for longer to try to get growth going again, even if it comes at the cost of mild inflation.At the same time, an appointee who is viewed as too soft on inflation or too close to the administration could cause problems. If financial markets doubt the Fed’s willingness to combat inflation, either because of appointees’ economic views or because of a perception that they want to boost growth in the run-up to the presidential election, interest rates could rise. That would slow the economy.

You see here a glimmer of why Klein is hesitant to come right out and say what he thinks. First, we have the already unsavory suggestion that the Fed should be treated as just another bureaucracy to be captured by the Left through the appointment of ideologues to supposedly non-partisan “career” positions. Klein doesn’t seem to know what a central bank is. The Fed can act rapidly and in incredible size during a crisis, and without checks and balances (aka, Republicans). At a time when the Left feels hemmed in by the traditional political process at every step, the Fed looks like the one institution that can be the archetypical “man of action.” The Fed needs that independence – it’s core to the mission of an inflation-fighting central bank – but it’s also the reason Congress allowed the Fed to be formed only with great trepidation and after 100 years of bitter debate, why its long, staggered terms tend to resist partisan Fed-packing, and why it’s emergency powers should be narrowly circumscribed and not extended into an ongoing, wholesale economic-emergency state that supplants political decisionmaking by the elected branches rather than a traditional central bank focused laser-like on a stable currency.

On the merits, Klein’s invocation of Irwin’s piece is even more menacing. The unnamed “liberal economists” mentioned here are essentially arguing for an inflationary policy of keeping interest rates artificially low, rather than focusing on keeping the currency stable, which is supposed to be what central bankers’ job is. While economic observers are divided on the importance of various contributing factors to the recent financial crisis, many smart observers argue that the Fed made the problem worse by keeping interest rates artificially low for too long, thus artificially reducing the cost of borrowing to invest in real estate, thus artificially inflating the asset bubble in real estate (at a minimum, the Fed did nothing to prevent the dynamics of an asset bubble from playing out the way asset bubbles do). The policy that Irwin describes with some skepticism, but which Klein apparently views as a godsend, runs the risk of repeating the exact same mistake and reinflating the same bubble. There are signs that we already have that problem; whether that worries you or not, we shouldn’t be advocating putting people on the Fed with an ideological agenda of exacerbating that process.

That’s the optimistic scenario. As Irwin notes, the pessimistic scenario is based on the fact that banks that lend at low rates get blindsided when inflation devalues their returns on those loans – thus, while easy money can cause inflation, fears of easy money causing inflation can simultaneously drive up interest rates and stifle job growth. That’s called stagflation – inflation plus high interest rates and high unemployment – and while Ezra Klein isn’t old enough to remember it from the Jimmy Carter era, in which interest rates cracked 20%, those of us who are do not want a Fed that thinks it’s an acceptable risk to run. (Indeed, it was the Fed under Paul Volcker that played a crucial role, along with the Reagan Administration, in breaking the back of stagflation and setting the stage for the booms of the 1980s and 1990s, even at the short-term cost of making the recession even worse).

Some degree of politics in Fed appointments is inevitable, and moreso given the vast powers the Fed has accrued in recent years. But Obama’s reappointment of Ben Bernanke, the Fed chair appointed by George W. Bush, and his grudgingly bipartisan confirmation by the Senate, is a reminder that even in the hyper-partisan Obama Era, there are some parts of the government in which nearly everyone recognizes that it’s still dangerous to put ideology and partisan self-interest above predictability and stability. Klein’s suggestion that Obama tilt the Fed towards the abyss of asset bubbles or stagflation is a reminder that a lack of common sense and experience can be a dangerous thing.